ESG: High Demand and Strong Performance Despite Market Volatility

ESG, or Environmental, Social and Governance, investing has garnered much attention since the Global Financial Crisis. Increasing numbers of investors are striving to align their investments with their values, and many have sought-out various forms of ESG investment products in order to accomplish this. Despite early concerns that these investments would not keep up with traditional benchmarks, a wide range of reports1 have indicated that investing in sustainability has not only kept up with, but in many cases exceeded, the performance of traditional investments.

However, there has been one nagging concern that critics of ESG like to bring up: most of the performance being analyzed has taken place during a 10-year bull market. Sure, ESG has performed well recently, but what about when the market drops? This would surely prove that ESG investors are leaving something on the table by avoiding lucrative-but-irresponsible companies, right?

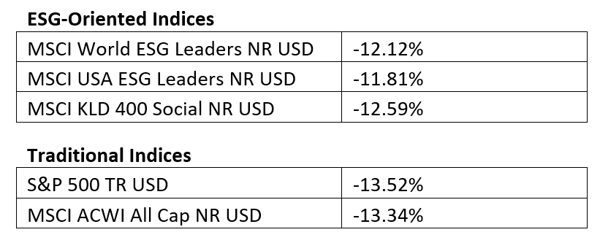

Wrong! Looking at performance data from the fourth quarter – a period that saw the S&P 500 Index fall 13.52% – some ESG benchmarks outperformed traditional indices.

Q4 2018 Performance – ESG versus Traditional Investments

Source: Morningstar Direct. Time Period: 10/1/2018 – 12/29/2018

Source: Morningstar Direct. Time Period: 10/1/2018 – 12/29/2018

The outperformance of ESG during the volatility of the fourth quarter may help explain why amid the ups and downs of the year, 55% of RIAs said their clients were interested in ESG investments, according to TD Ameritrade Institutional’s latest RIA Sentiment Survey.1 We would expect this interest to increase, given the positive story behind ESG and strong relative performance in both up and down markets.

Dana has a strong history in managing Social ESG investment strategies for clients. We also sub-advise the Eventide Limited Term Bond Fund (ETIBX) and recently became the investment advisor for the Dana Epiphany ESG Equity Fund (ESGIX). We encourage you to contact us if you are interested in learning how these funds can help meet the needs of your clients.

The universe of acceptable investments for the Fund may be limited as compared to other funds due to the Fund’s ESG investment screening. Because the Fund does not invest in companies that do not meet its ESG criteria, and the Fund may sell portfolio companies that subsequently violate its screens, the Fund may be riskier than other mutual funds that invest in a broader array of securities.

The MSCI World ESG Leaders Index and the MSCI USA ESG Leaders Index are capitalization weighted indexes that provide exposure to companies with high Environmental, Social and Governance (ESG) performance relative to their sector peers. The MSCI World ESG Leaders Index is constructed by aggregating several regional indexes; the parent index is MSCI World Index, which consists of large and mid-cap companies in the 23 Developed Markets Countries. The MSCI USA ESG Leaders Index consists of large and mid-cap companies in the US market. The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts.

The S&P 500 Index is a widely recognized unmanaged index of equity prices. The MSCI ACWI is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world.

The Dana Epiphany ESG Equity Fund (ESGIX) is distributed by Unified Financial Securities, LLC. The Eventide Limited Term Bond Fund (ETIBX) is distributed by Northern Lights Distributors, LLC. Unified Financial Securities, LLC. and Northern Lights Distributors, LLC. are under common control.

1The links above open new windows that are not part of www.danafunds.com.