Is Value Investing Back in Vogue?

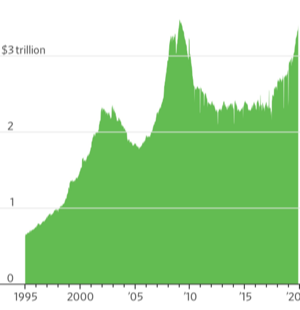

An interesting dichotomy has developed between the collective psychology of investors and market performance. In a hint of growing uncertainty, investors’ cash allocations have grown $1 trillion over the last three years to levels unseen since 2009. (See chart 1 below). Given the current environment, investor trepidation is understandable. The U.S. remains in an on-again, off-again trade war with China, economic growth has been lackluster as stagnating manufacturing data continues to wrestle with decent services growth, and impeachment hearings have brought to a boil the nation’s political animus. Yet, despite the uncertainty, markets averages have soldiered on to new highs.

CHART 1: Assets in Money-Market Accounts

Accompanying the recent advance has been a hand off in leadership. The FANG (Facebook, Apple, Netflix and Alphabet (previously Google)) bell-wethers that have led the charge most of the year have stalled out as Amazon and Netflix profits have disappointed while Facebook and Alphabet have struggled under the regulatory microscope. The IPO market has cooled as well. Peleton, Uber and Beyond Meat are notable new issues that have struggled under the public eye. Reflecting this slowing leadership, the MSCI USA Momentum Index rose 0.63% in October, trailing the S&P 500’s 2.0% gain.1

As the FANG names have cooled, a wider number of stocks, including value stocks, have driven the market higher recently, as illustrated by the graph below. The top line shows the performance of the Russell 1000 Index, while the bottom line shows the Advance/Decline line, which is an indicator of market breadth. It measures the difference between the number of advancing and declining stocks.2

CHART 2: Russell 1000 Index and Growing Number of Contributors (Market Breadth)

Trailing One-Year as of 11/15/2019

Source: marketinout.com

These recent market events, albeit a relatively short timeline, suggest that the performance baton is potentially changing hands from momentum to value stocks. With so much cash waiting on the sidelines it is possible that the relative attraction of value continues. Though we are not solely focused on value, we welcome the potential shift and broadening of investor focus in which no one factor is so dominant in determining the overall performance. In such market, we believe companies that are underpriced relative to their peers, with growth trajectories that offer potential appreciation and inherently valuable business models and asset bases, should flourish.

If you would like to be notified when we release new market insights, please fill out the form on this page, "Stay up to date with current market trends," and we will send you an email.

1 Evie Liu, “When Momentum Stocks Can’t Live Up to Their Name,” Barron’s, November 1, 2019.

2 https://www.marketinout.com/chart/market.php?breadth=advance-decline-line

The links above open new windows that are not part of www.danafunds.com.

Dana Large Cap Equity Fund top-ten holdings as of September 30, 2019: Apple, Inc. (2.36%), Alphabet, Inc. Class A (2.28%), Microsoft Corp. (2.21%), CDW Corp. (2.20%), Comcast Corp. (A) (2.02%), D.R. Hoton, Inc. (2.10%), Intel Corp. (2.09%), Bristol-Myers Squibb Corp. (2.06%), T-Mobile, Inc. (2.04%), Thermo Fisher Scientific, Inc. (2.01%).

Dana Small Cap Equity Fund top-ten holdings as of September 30, 2019: Cabot Microelectronics Corp. (2.28%), CoreSite Realty Corp. (2.07%), EastGroup Properties, Inc. (2.06%), Chesapeake Utilities Corp. (2.04%), Horizon Therapeutics (2.03%), Southwest Gas Corp. (2.02%), Centerstate Bank Corp. (2.00%), Banner Corporation (1.99%), Synnex Corp. (1.99%), Stag Industrial, Inc. (1.97%).

Dana Epiphany ESG Equity Fund top-ten holdings as of September 30, 2019: Nexterra Energy, Inc. (2.76%), Amazon.com (2.74%), PepsiCo, Inc. (2.70%), Apple, Inc. (2.65%), Automatic Data Processing (2.55%), Microsoft Corp. (2.41%), Alphabet, Inc. Class C (2.40%), American Express Co. (2.15%), Facebook, Inc. (2.11%), Intel Corp. (2.03%).

Value investing involves the risk that an investment made in undervalued securities may not appreciate in value as anticipated or remain undervalued for long periods of time.