Home for the Holidays? Not in this Housing Market.

Published on

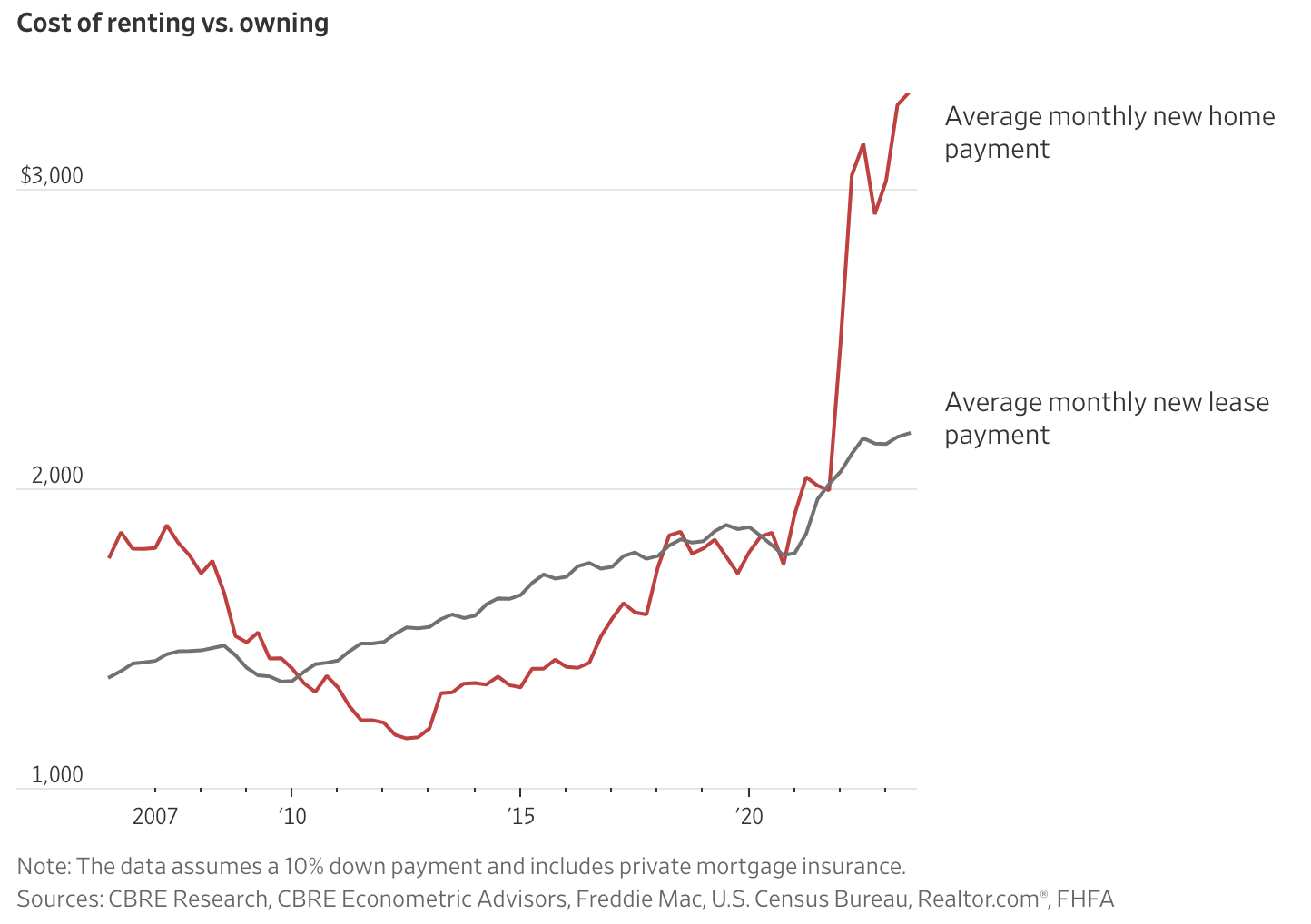

- If a new home is on your holiday wish list, consider this: It now costs 52% more to buy a home than to rent.

- A home buyer with the median U.S. income would have spent a record 41% of earnings on monthly housing costs in 2023, compared to 39% in 2022 and 31% in 2021.

- High interest rates are the culprit: 11 rate hikes in more than a year have triggered a substantial jump in mortgage rates, which, in October, reached their highest level in more than 23 years. (With inflation cooling somewhat, they’ve recently moved lower.)

- Home ownership might be part of the American Dream, but in the current market, choosing to rent makes more financial sense. Another benefit of renting? Leaky faucets are the landlord’s problem, not yours.

Tags:

Chart of the Month