A Decade in Review - Central Banks Take the Wheel

As we approach a new decade, we’d like to take a moment to reflect on some of the most memorable changes from the 2010s. In a 3-part blog series, we will cover central banks, how mobile has changed our world, and the effects of climate change.

Central Banks

Perhaps the biggest change in the financial markets over the past ten years is the evolution of the Federal Reserve from a somewhat autonomous, esoteric monetary policy making body to an almost ubiquitous actor in monetary, economic and political policy. In 2010 Federal Reserve Chairman Ben Bernanke was an anonymous figure, known by few outside financial circles. Today, Chairman Jerome Powell is mentioned weekly in tweets by the President.

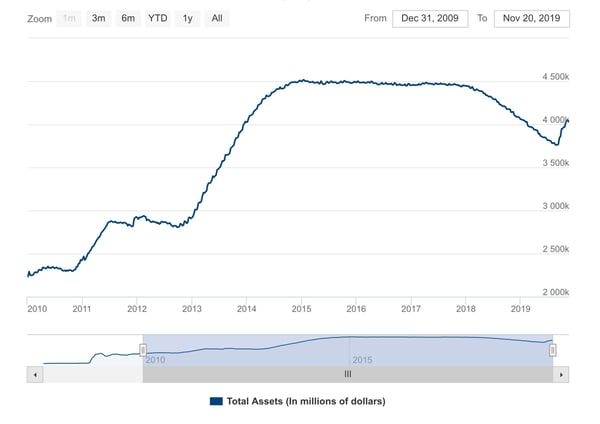

Ushering in this change was the massive response to financial crisis and the Great Recession: Troubled Asset Relief Program (TARP) and quantitative easing (QE). TARP was meant as a short-term elixir to kick-start a malfunctioning banking system, while QE was never supposed to become an embedded, institutionalized policy. Yet, the last decade saw the second, third and “twist” iterations of this experiment, each intended to address a unique market dislocation along the way. All tolled, the Fed’s balance sheet grew 81.0% over the decade to $4 trillion. (See Chart 1).

Chart 1

Source: Federal Reserve

This policy accommodation has had benefits. Over the decade gross domestic product (GDP) has grown from $14.4 trillion to $20.2 trillion unemployment has fallen from 9.9% to 3.6% and the S&P 500 has rallied a mere 178.9%. There have, however, been tradeoffs. QE has suppressed interest rates, and led to the buildup of federal debt from $12.3 trillion to $22 trillion, a record 103% of GDP. Despite the massive liquidity injections, economic growth has averaged a stagnant 2.5%. And while nobody complains about stock market gains, QE has ushered an era of asset prices impacted by money flows as much as by fundamentals.

The European Central Bank (ECB) now owns $4.6 trillion in financial assets. The Bank of Japan (BoJ) holds Y575 trillion. The size of these balance sheets limits flexibility, as witnessed by the “taper tantrum” in 2013. As such, we enter a new decade with monetary and fiscal policy a fixture in financial markets.

If you would like to be notified when we release our upcoming articles

in this Decade in Review blog series, please sign up here.

Source: Stats in this article are from the Fed.