Do Not Fear the Correction

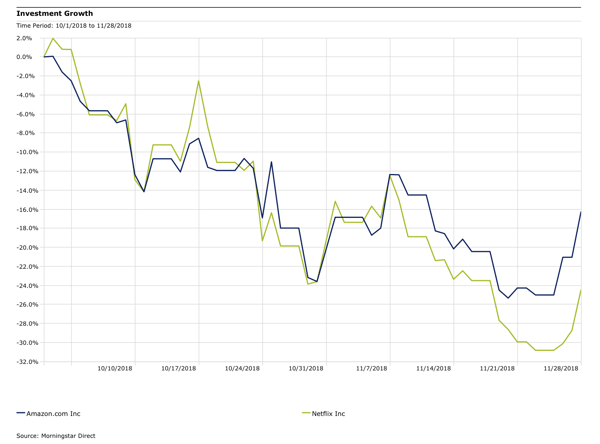

Large- and small-cap indices have fallen significantly since the end of September, in a correction that has caught many investors off guard. Recent darlings, such as Amazon and Netflix, fell over 20% and 30%, respectively, before finding support.

However, we really shouldn’t be surprised when stocks with P/E’s of 50 to 100 and year-to-date returns of 50% to 100% undergo a correction. These stocks should be expected to exhibit downside volatility that is similar to their upside volatility when their future growth rates are questioned. High P/E stocks are most sensitive to changes in their expected growth rates in the future. Also, all market trends typically both overshoot and undershoot their natural equilibrium points.

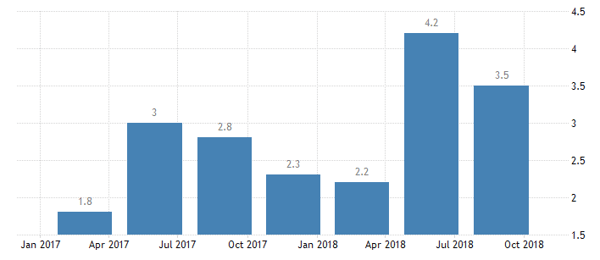

Even in hindsight, it is impossible to time market corrections. Regarding the current correction, there are a vast number of factors that are being held responsible. Eventually, earnings growth will inevitably slow from the 20% rate we have seen the last few quarters, although currently it remains strong. Additionally, Q3 GDP growth came in at 3.5% following a second quarter that was revised up to 4.2%. These are the strongest two quarters of GDP growth that the U.S. has experienced in four years.

U.S. GDP Growth Rate (QoQ)

Source: Tradingeconomics.com

The Fed and higher rates could be held responsible for a correction in the future, but certainly not now. The 10-year Treasury is still in the low 3’s and has only crept up at about the rate of recent short-term rate increases. No serious signs of inflation have reared their heads yet. A China slowdown has been pointed to as a possible factor, and its currency and stock markets are certainly struggling this year against the almighty dollar.

So will earnings growth ‘peak’ at some point in the future? Of course, and, in our opinion, it most certainly will start slowing from its current 20% growth rate soon. We believe there is no recession on the horizon, and the correction we are having does not seem to be anything more than that. Corporate bond spreads have behaved, there has been no huge rally in Treasuries, and inflation still seems to be well behaved, especially with currently-weak commodity prices. Even Yeti, the premium cooler maker and ‘lifestyle’ brand, was able to get their IPO done last week at 2X last year’s sales. As for the correction, the current health of the economy indicates this too shall pass.

Dana Large Cap Equity Fund top-ten holdings as of September 30, 2018: Apple Inc. (2.48%), Pfizer Inc. (2.36%), Amgen Inc. (2.21%), WellCare Health Plans, Inc. (2.18%), UnitedHealth Group Inc. (2.15%), Stryker Corporation (2.12%), Alphabet Inc. Class A (2.10%), Microsoft Corporation (2.10%), Bristol-Myers Squibb (2.05%), Johnson & Johnson (2.03%).

Dana Small Cap Equity Fund top-ten holdings as of September 30, 2018: Universal Insurance Holdings, Inc. (2.34%), Bottomline Technologies, Inc. (2.14%), Ligand Pharmaceuticals, Inc. (2.05%), Marcus Corporation (2.03%), Emergent BioSolutions Inc. (2.00%), Primerica, Inc. (1.99%), Boot Barn Holdings, Inc. (1.98%), BioTelemetry Inc. (1.87%), Chefs' Warehouse, Inc (1.83%), Comfort Systems USA, Inc. (1.83%).

Price/Earnings (P/E) is the price of a stock divided by its earnings per share.