ESG Investing During An Energy Crisis

An Energy Crisis Reveals a New Twist on ESG Investing

ESG investing continues to evolve. The world is coming around to the notion that it is not so simple as shunning companies that have significant oil, coal, and nuclear energy exposure. The ongoing and deepening energy crisis in Europe casts an unfortunate spotlight on the perils of too quickly moving away from important base load fuel sources for electricity generation. At Dana, we take a more nuanced approach to ESG investing. While we believe that clean power will emerge as a significant energy source that will shape our world in the years ahead, getting there is fraught with challenges — at home and abroad.

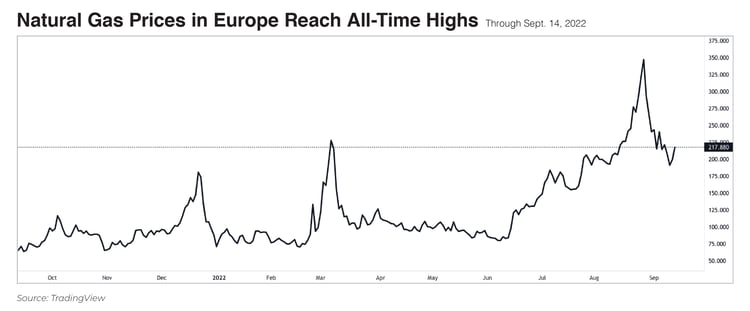

Energy Prices Across Europe Jump to Unimaginable Levels

In August, natural gas prices across the pond surged to all-time highs. The Dutch TTF natural gas contract traded at the equivalent of more than $400 per barrel of oil. Fueled by fears of gas shortages this coming winter and unavoidable spikes in demand, the parabolic climb in TTF sent year-ahead power futures prices soaring in Germany and France. Unless something drastically changes, families in those large, developed countries will face the gut-wrenching decision to heat their homes or put food on the table.

Major problems along the path to a clean energy future are not unique to Europe, though. Just take a look at the February 2021 Texas freeze-out. Back then, record-breaking cold temperatures for mornings on end limited the supply of natural gas. Oil and gas rigs could not produce due to the bone-chilling cold, pipelines struggled to move the fuel, and some power plants were forced offline due to the conditions. Of course, wind and solar power were not there to support sky-high heating demand. It’s obvious (and now tragic) that shutting down fossil fuel production with great haste, before adequate alternative energy solutions are online, upends the energy market and increases risk while decreasing grid reliability. Is it possible that, for the moment, oil and gas companies have underappreciated ESG attributes? If they can produce and deliver power when it is needed most at an affordable price, lives and livelihoods might be saved this winter. What’s better on the ESG scale than that?

Major problems along the path to a clean energy future are not unique to Europe, though. Just take a look at the February 2021 Texas freeze-out. Back then, record-breaking cold temperatures for mornings on end limited the supply of natural gas. Oil and gas rigs could not produce due to the bone-chilling cold, pipelines struggled to move the fuel, and some power plants were forced offline due to the conditions. Of course, wind and solar power were not there to support sky-high heating demand. It’s obvious (and now tragic) that shutting down fossil fuel production with great haste, before adequate alternative energy solutions are online, upends the energy market and increases risk while decreasing grid reliability. Is it possible that, for the moment, oil and gas companies have underappreciated ESG attributes? If they can produce and deliver power when it is needed most at an affordable price, lives and livelihoods might be saved this winter. What’s better on the ESG scale than that?

How Dana’s ESG Investing Method Applies Now

Dana’s approach considers all facets of ESG. We prefer to own companies that are strong on balance across environmental, social, and governance metrics. Our Dana Epiphany ESG Funds owns several traditional energy stocks. We believe these companies have a place in society. Moreover, they generally exhibit positive “S” and “G” characteristics that also matter deeply to Dana and our investors. And what many other fund managers new to the socially responsible investing world might miss is that certain aspects of ESG impact other parts of ESG. For example, as evidenced by the crisis in Europe, transitioning away from fossil fuels too quickly results in severely negative societal impacts. Our experience with ESG, spanning more than two decades, helps us see the big picture and recognize opportunities other managers miss. Dana’s process includes leveraging ESG research from 11 different vendors as well as our in-house ESG analyst.

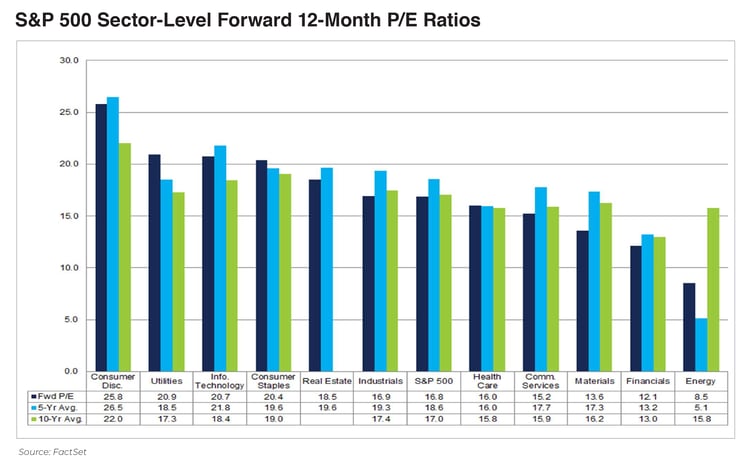

Our unique investment process does not count out broad swaths of the energy market. A sector-neutral and equal-weight method ensures we have exposure to the energy sector. While we don’t encourage it, if you flip on financial TV, you’ll likely hear the talking heads clamor about owning high free cash flow* companies at good valuations. Where is that right now? Energy. According to J.P. Morgan and FactSet, the sector’s forward price-to-earnings ratio looks inexpensive at just 8.7 times next year’s earnings. Our steadfast portfolio construction process ensures that we are exposed to this high relative value part of the stock market. We continue to drill down to find companies with strong balance sheets, low levels of debt, and high free cash flow generation.

Forward 12-Month Price-to-Earnings Ratios by Sector: Energy Sports the Lowest Valuation

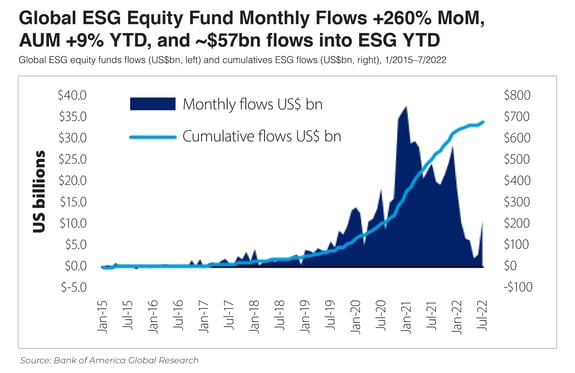

Is ESG Losing Its Luster in the C-Suite and Among Investors?

ESG is clearly having a moment right now. While an energy debacle in Europe persists, the growth rate in the number of companies mentioning “ESG” on earnings calls has dropped.i Moreover, investors have suddenly pulled back on putting money to work in the space. After massive inflows into global ESG equity funds during 2020 and 2021, there has been a sharp drop this year. It appears that other macro concerns are top of mind among company executives and investors. We remain focused on uncovering strong ESG companies to include in our portfolios. It’s also part of our mission to equip and empower advisors to understand ESG so that they can have thoughtful conversations with clients — other ESG managers fail to take that extra step.

So, while the popularity and investment community views on ESG rock back and forth, Dana’s long-time experience helps us remain grounded in where we want to position capital.

So, while the popularity and investment community views on ESG rock back and forth, Dana’s long-time experience helps us remain grounded in where we want to position capital.

We also help advisors understand ESG so they can explain it to their clients in a non-political, no-nonsense way. Dana does not see ESG going away any time soon — investors will continue to demand that their dollars be put to work in companies doing the right things. Dana’s team will keep doing what we have always done — invest in the right companies in a balanced way.