Fixed Income as Financial Armor

When we speak with investors about the benefits of allocating to fixed income, we sometimes share a narrative from the 1940s that mirrors the philosophy behind the role bonds can play in helping to stabilize portfolios.

The story unfolds with Abraham Wald, co-founder of the statistics department at Columbia University and a key member of the University’s Statistical Research Group (SRG), a research organization that, in the 1940s, was the nerve center of wartime math.

Survival in the Skies

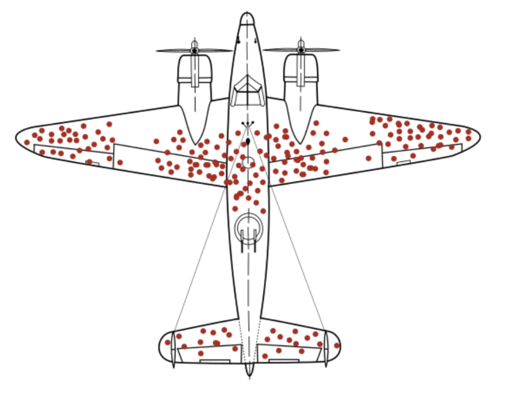

In 1943, the SRG was challenged to determine how to armor warplanes to minimize damage from enemy fire without compromising maneuverability and fuel efficiency. The military, armed with data on bullet holes in returning planes, sought an optimal solution to concentrate armor where it was needed most. Their theory was to reinforce the bombers by adding armor to the areas with the most bullet holes. Wald had a different idea.

Instead of focusing on the visible damage to surviving planes, he focused on the unseen vulnerabilities of the planes that didn't make it back. Presuming the planes that didn’t return were hit in the engines, he proposed the military fortify the engine– the part of the plane where damage wasn't evident. They followed Wald’s recommendation and subsequently saw a greater survival rate among the bombers.

Hypothetical Pattern of Bullet Holes in Surviving WWII Aircraft

Wald's approach to the bullet hole problem became a crucial lesson in strategic thinking and risk management – a timeless principle applicable not only in military aviation but also a valuable lesson for investors, particularly those navigating the unpredictable terrain of financial markets.

The Engine and Armor Analogy

We can’t help but draw a parallel between Wald's strategy of fortifying warplanes by adding a protective layer of armor around their engines and an investor’s strategy of fortifying their portfolio by adding high-quality fixed income to complement their equity allocation. Simply put, if equities act as the engine of a portfolio, then fixed income may serve as the protective armor around the engine, offering a measure of stability amid the turbulence of financial markets.

In navigating the complexities of financial markets, we think it’s worth taking a page from history and considering the unseen risks – fortifying portfolios not where the “bullets” have already hit, but where they might strike next. A well-placed layer of armor could make all the difference between survival and defeat.

For additional insights on Dana’s approach to building, customizing, and managing fixed income portfolios, read “Thinking Outside the Box.”