The Duration Risk Management Failure at Silicon Valley Bank

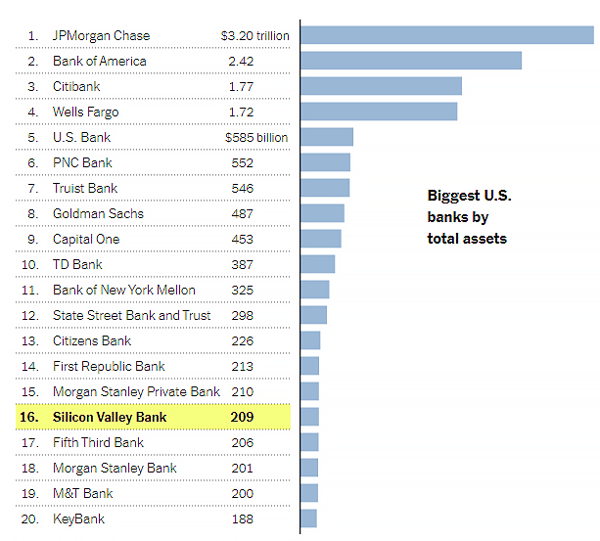

Investors may be skittish right now following the collapse of SVB Financial (SIVB) also known as Silicon Valley Bank. Memories of 2008 quickly rose to the surface after what was once America’s 16th largest bank that had been in existence for more than four decades took just a few days to go bust.i This time may indeed be different, though. The Financials sector is on sounder footing compared to the leveraged period of the mid-2000s and SIVB’s crisis was primarily rooted in the mismanagement of its assets and liabilities. As a result of extreme duration risk taken on by the tech-exposed bank, all it took was a fear that the company would not be able to meet all its depositors’ demands to turn the bank insolvent.

SIVB: Once One of America’s Largest Banks

Source: Federal Reserve Board, The New York Times

A Crash Course in Banking

Banks commonly borrow short and lend long. They take in deposits, pay what’s usually a small rate on checking and savings accounts, and then extend credit to borrowers at longer maturities and higher rates. That spread is known as the net interest margin. It’s banking 101. And part of that process is hedging against adverse changes in the yield curve. The sweet spot for a bank, particularly regional banks that do business with individuals and small businesses, is when the Treasury yield curve is upward-sloping and steepening. In such instances, a financial institution can earn hefty spreads between the deposit rates it pays out and the long-term rates it earns on loans.

But even when the spot rate is high, deposits tend to be sticky as it is a headache for you and me to close out one account, and go open another, just to capture a slightly higher yield on our savings. Thus, a bank can still be profitable when the yield curve is inverted as it can purchase Treasury bills at a relatively high interest rate and pay lower yields on deposits. According to Bankrate as of March 15, the average interest rate on a savings account is just 0.23% while 3-month T-bills yield about 4.5%.ii That’s not a bad environment for banks that can manage risk well.

SIVB’s Downfall

So, what went wrong at SIVB? It simply did a dreadful job of managing its assets and liabilities. It failed to hedge its long positions in far-dated Treasuries and mortgage-backed securities (MBS). These were and are high-quality assets — it's not like the Great Financial Crisis (GFC) in that the securities owned were of premium quality. What’s more, it was not a crisis of bad loans made — SIVB’s failure was on balance sheet risk mitigation.

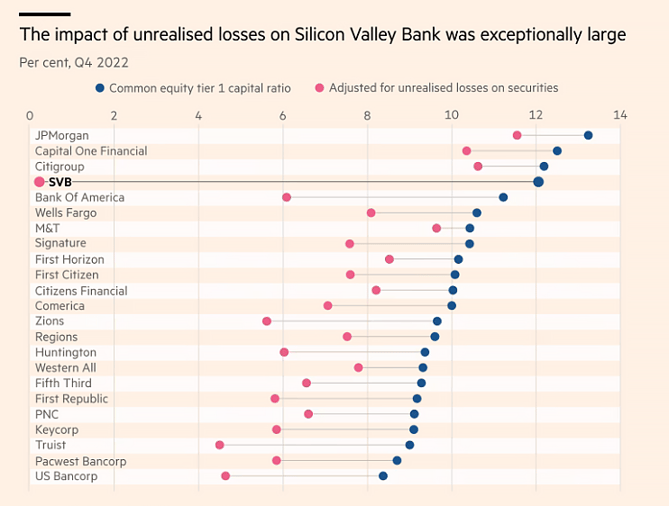

Think back to just a year ago. Interest rates had just begun to rise, and inflation was flaring up. When yields march higher, bond prices fall. So, SIVB’s book of long-duration Treasuries and MBS fell in value. Due to the accounting treatment of many of those holdings, prices of so-called “held-to-maturity” assets indeed declined, but the bank would only have to mark losses on its books at maturity or if it sold them in the market. That masked the deterioration of SIVB’s capital ratios. Another idiosyncratic feature of the California firm is that its customer base was almost exclusive to the tech venture capital (VC) and private equity (PE) space. As that market cooled rapidly in 2022, deposit growth retreated. A storm was brewing.

Slow at First, Then All at Once

By March this year, madness was about to be unleashed that would rock the global financial markets. A failed capital raise led to fears that the bank might be unable to make good on its deposits. The crisis in confidence was made real when some influencers on Twitter urged account holders to pull their cash from the bank. It is as if the tech crowd turned on itself. A bank run ensued, and in an ironic twist, technology made it easier than ever to pull money from one bank and park it in another.

Amid the liquidity drain, SIVB was forced to sell some of its “available-for-sale” assets, further harming its held-to-maturity portfolio’s value. Capital ratios plunged even more. Bank regulators finally stepped in and put SIVB into receivership on March 10.iii A consortium of the Federal Reserve, Treasury Department, and FDIC then backstopped customers’ cash to prevent massive losses as nearly 90% of total deposits had been above the $250,000 FDIC insurance limit. In the end, at $209 billion, it was the second-largest U.S. bank failure in history, and the largest since the 2008 unraveling of Washington Mutual.iv New York-based Signature Bank (SBNY) would founder shortly after, and contagion fears became front and center.

Is Another GFC Underway? Unlikely.

But we do not believe another 2008 is unfolding. While it seemingly was a perfect storm of events that brought down SIVB, it could have been avoided with proper interest rate hedging. The fact that the bank had no Chief Risk Officer for most of last year is a glaring governance failure.v Asset-liability matching is something finance students and aspiring portfolio managers learn in undergrad college courses. It’s also a major topic in the CFA program that so many analysts have gone through.

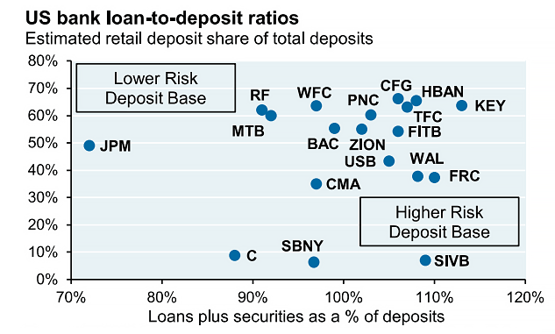

Perhaps the good news is that SIVB was in a league of its own regarding its risk profile and level of risk management. Its loan-to-deposit ratio was high while its retail share of deposits, which we said before is stickier compared to just having a large institutional deposit base, was exceptionally low. Also, SIVB was a unicorn (or black swan) when comparing its common equity tier 1 capital ratio, adjusted for losses on securities, to other banks. The nation’s largest financial institutions have liquidity ratios of 100% or better, so the broader system should be able to weather this storm, though we expect volatility to persist.

SIVB: The Worst of the Bank Bunch with a High-Risk Deposit Base

Source: J.P. Morgan Asset Management

SIVB’s Uniquely Poor Balance Sheet Quickly Came to Light in March 2023

Source: The Financial Times

Harnessing Volatility to Our Benefit

At Dana, we are using this current period of market turmoil to identify what is on sale, employing our relative value process. While our team is cognizant of heightened risks, and there could always be more shoes to drop, our more than four decades of experience navigating tumultuous markets is a major arrow in our quiver. What’s ideal about times like these is that broad-based selling on Wall Street brings about value opportunities for patient and disciplined investors like us. Our risk-controlled portfolio construction and management processes are differentiating factors in protecting clients’ assets.

The Bottom Line

We see the SIVB saga as a firm-specific failure of risk management rather than a harbinger of another systemic financial crisis. While it will no doubt continue to send shockwaves across the sector and bring about heightened market volatility, banks are better positioned today to absorb the blow. Other economic vital signs are decent, too, so we are using this pullback to take advantage of undervalued stocks and bonds.

You can reach out to us to learn more about how Dana can improve your investment plans and help you build resilient portfolios.